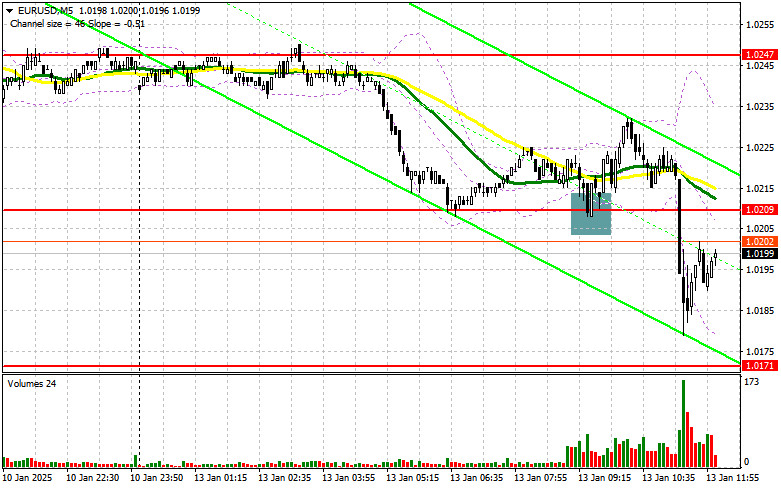

In my morning forecast, I highlighted the level of 1.0209 and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. A decline followed by the formation of a false breakout at that level provided a buying opportunity, which resulted in a 20-point growth before pressure on the pair resumed. The technical picture for the second half of the day remains unchanged.

To Open Long Positions on EUR/USD:

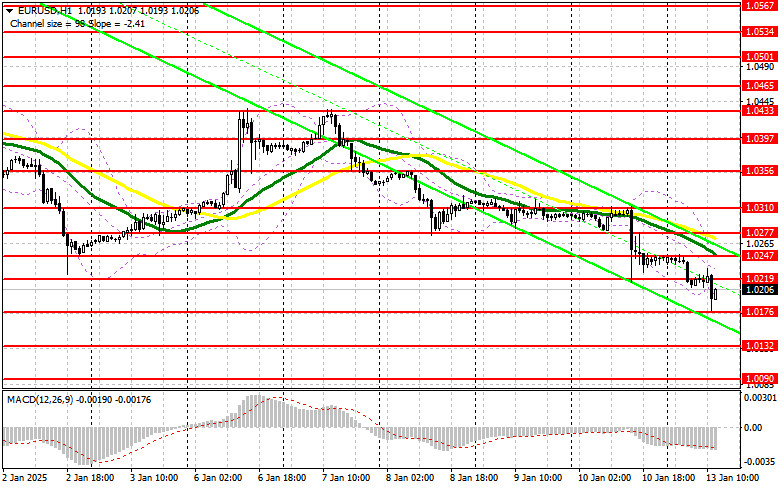

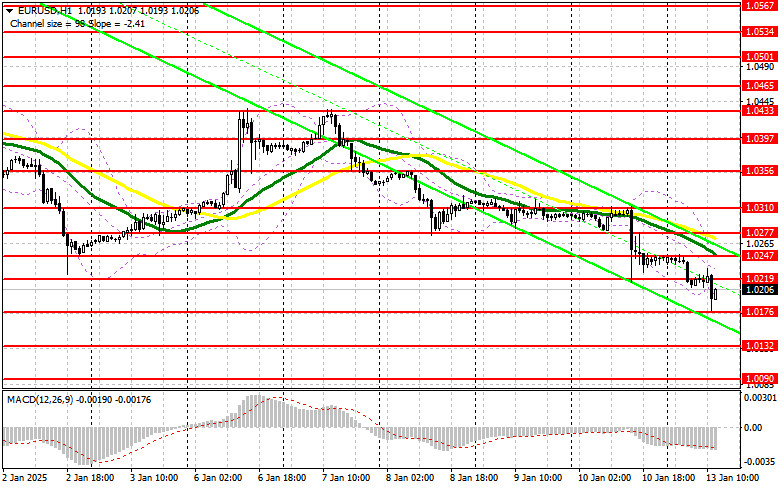

The euro remains under pressure, which is unsurprising. Following US news and statements by European policymakers about the possibility of more aggressive rate cuts by the European Central Bank, there is little hope for upward momentum in the EUR/USD pair. Unfortunately, there are no significant economic data releases from the US this afternoon, so it is better to continue acting in line with the existing bearish trend while remaining cautious about potential corrections in the pair.

If pressure on the pair persists, I plan to act only around the nearest support at 1.0176, which narrowly missed a test during the first half of the day. A false breakout formation at this level would provide a good buying opportunity, aiming for resistance at 1.0219. A breakout and retest of this range from above would confirm a proper entry point for further buying, with targets at 1.0247. The ultimate target will be the 1.0277 high, where I plan to take profits.

If EUR/USD continues to decline and there is no bullish activity around 1.0176 in the afternoon, the pressure on the pair will likely increase, allowing sellers to reach 1.0132, a new yearly low. Only after a false breakout there would I consider entering long positions. I will open long positions on a direct rebound from 1.0090, targeting a 30-35 point upward correction during the day.

To Open Short Positions on EUR/USD:

Sellers wasted no time resuming pressure on the euro, aiming to reach parity with the dollar in the coming weeks. Given the lack of US statistics this afternoon, the pair may experience a correction, so caution with shorts is advised. A false breakout at 1.0219 would provide an entry point for short positions, aiming for support at 1.0176. A breakout and consolidation below this range, followed by a retest from below, would serve as another suitable selling opportunity, targeting the yearly low at 1.0132, which would strengthen the bearish trend. The ultimate target will be 1.0090, where I plan to take profits.

If EUR/USD moves higher in the second half of the day and sellers fail to show activity around 1.0219, where moving averages are also bearish, I will postpone short positions until the next resistance test at 1.0247. I will sell there only after a failed consolidation. I plan to open short positions on a direct rebound from 1.0247, aiming for a 30-35 point downward correction.

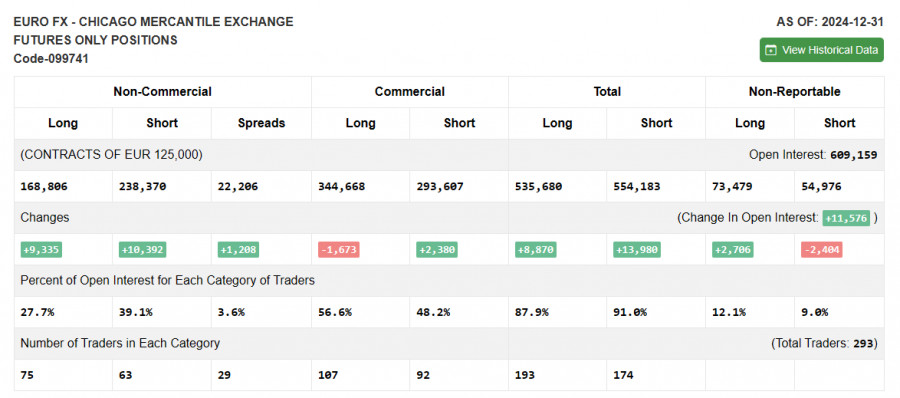

The COT report for December 31 showed nearly equal growth in both short and long positions. Considering that the Federal Reserve's policy remained unchanged before the new year, attention is likely shifting to Donald Trump's inauguration and his protectionist rhetoric. However, any statements by Federal Reserve officials will also play a significant role in the future course of the US dollar and should not be ignored. The COT report indicates that long non-commercial positions increased by 9,335 to 168,806, while short non-commercial positions increased by 10,392 to 238,370. As a result, the gap between long and short positions widened by 1,208.

Indicator Signals:

Moving Averages:

Trading occurs below the 30- and 50-day moving averages, indicating further pair declines.

Note: The author considers moving averages on the H1 chart, which may differ from the classic D1 definition.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator near 1.0205 will act as support.

Indicator Descriptions:

- Moving Average: Indicates the current trend by smoothing volatility and noise. Period: 50 (yellow line), 30 (green line).

- MACD: Moving Average Convergence/Divergence. Fast EMA: 12, Slow EMA: 26, SMA: 9.

- Bollinger Bands: Period: 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and institutions using futures markets for speculative purposes.

- Long Non-commercial Positions: Represents the total long open positions of non-commercial traders.

- Short Non-commercial Positions: Represents the total short open positions of non-commercial traders.

- Net Non-commercial Position: The difference between short and long positions held by non-commercial traders.