Разбор сделок и советы по торговле британским фунтом

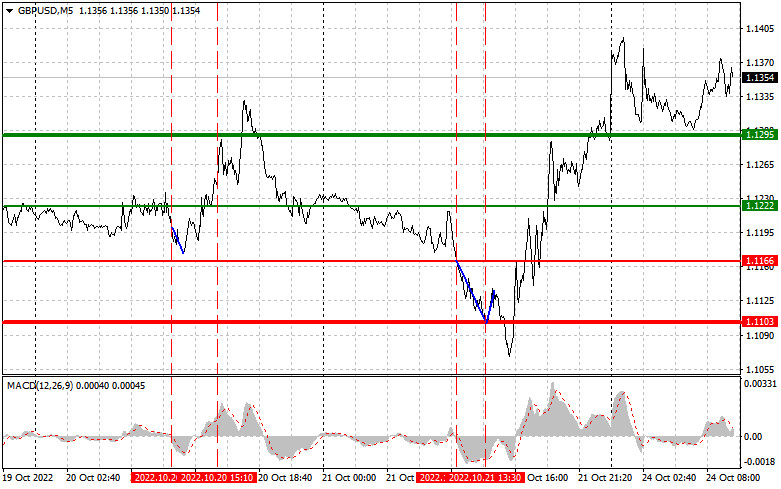

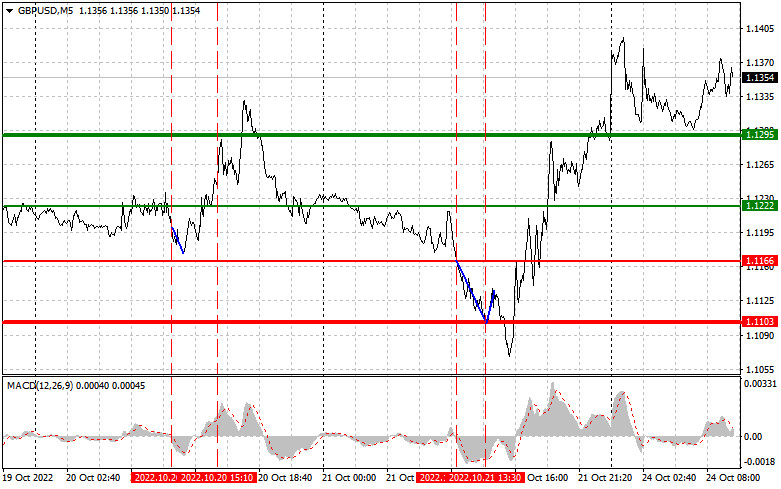

Тест цены 1.1166 произошел в момент, когда MACD много только начинал движение вниз от нулевой отметки, что стало подтверждением правильно точки входа на продажу фунта. Падение составило более 60 пунктов. Ближе к середине дня состоялся тест 1.1103, где я советовал покупать сразу на отскок, что привело к рывку вверх на 20 пунктов, однако затем давление на пару вернулось.

Пятничные данные по изменению объёма розничной торговли в Великобритании разочаровали, как и показатели по объему заемных средств государственного сектора. Сегодня нас ждет довольно важная статистика по активности в Великобритании – особенно в секторе услуг. Ожидаются показатели по индексу деловой активности в секторе услуг, в производственном секторе и композитный индекс PMI Великобритании. Снижение индексов может потянуть за собой вниз и британский фунт, так что советую ставить на продажу в первой половине дня. Речь замглавы Банка Англии Рамсдена вряд ли будет иметь серьезное влияние на британский фунт. Во второй половине дня ожидаются аналогичные отчеты и по американской экономике. Там активность остается на более-менее приемлемом уровне, так что можно ожидать укрепления доллара. Если по каким-то причинам индексы также начнут резко снижаться, фунт может резко вырасти против доллара США.

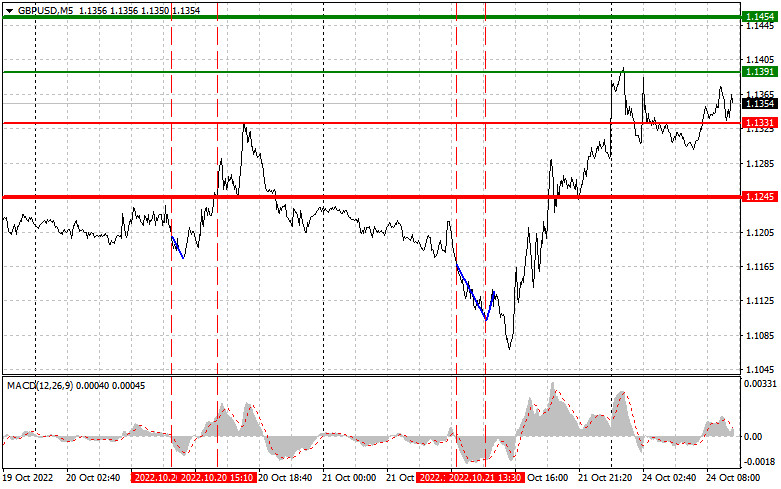

Сигнал на покупку

Сценарий №1: покупать фунт сегодня можно при достижении точки входа в районе 1.1391 (зеленая линия на графике) с целью роста к уровню 1.1454 (более толстая зеленая линия на графике). В районе 1.1454 рекомендую выходить из покупок и открывать продажи в обратную сторону (расчет на движение в 30-35 пунктов в обратную сторону от уровня). Рассчитывать на рост фунта можно только после хорошей статистики. Важно! Перед покупкой убедитесь в том, что индикатор MACD находится выше нулевой отметки и только начинает свой рост от нее.

Сценарий №2: покупать фунт сегодня также можно в случае достижения цены 1.1331, но в этот момент индикатор MACD должен находиться в области перепроданности, что ограничит нисходящий потенциал пары и приведет к обратному развороту рынка вверх. Можно ожидать рост к противоположным уровням 1.1391 и 1.1454.

Сигнал на продажу

Сценарий №1: продавать фунт сегодня можно лишь после обновления уровня 1.1331 (красная линия на графике), что приведет к быстрому снижению пары. Ключевой целью продавцов будет уровень 1.1245, где рекомендую выходить из продаж, а также открывать сразу покупки в обратную сторону (расчет на движение в 20-25 пунктов в обратную сторону от уровня). Давление на фунт вернется в случае плохих цифр по сектору услуг, который все еще находится в плюсе и демонстрирует рост. Важно! Перед продажей убедитесь в том, что индикатор MACD находится ниже нулевой отметки и только начинает свое снижение от нее.

Сценарий №2: продавать фунт сегодня также можно в случае достижения цены 1.1391, но в этот момент индикатор MACD должен находиться в области перекупленности, что ограничит восходящий потенциал пары и приведет к обратному развороту рынка вниз. Можно ожидать снижения к противоположным уровням 1.1331 и 1.1245.

Что на графике:

Тонкая зеленая линия – цена входа, по которой можно покупать торговый инструмент;

Толстая зеленая линия – предположительная цена, где можно расставлять Take Profit или самостоятельно фиксировать прибыли, так как выше этого уровня дальнейший рост маловероятен;

Тонкая красная линия – цена входа, по которой можно продавать торговый инструмент;

Толстая красная линия – предположительная цена, где можно расставлять Take Profit или самостоятельно фиксировать прибыли, так как ниже этого уровня дальнейшее снижение маловероятно;

Индикатор MACD. При входе в рынок важно руководствоваться зонами перекупленности и перепроданности.

Важно. Начинающим трейдерам на рынке Форекс необходимо очень осторожно принимать решения по входу в рынок. Перед выходом важных фундаментальных отчетов лучше всего находиться вне рынка, чтобы избежать попадания в резкие колебания курса. Если вы решаетесь на торговлю во время выхода новостей, то всегда расставляйте стоп-приказы для минимизации убытков. Без расстановки стоп-приказов вы можете очень быстро потерять весь депозит, особенно если не используете мани-менеджмент, а торгуете большими объемами.

И помните, что для успешной торговли необходимо иметь четкий торговый план, по примеру такого, который представлен мною выше. Спонтанное принятие торговых решений исходя из текущей рыночной ситуации является изначально проигрышной стратегией внутридневного трейдера.