Analysis of Wednesday's Trades

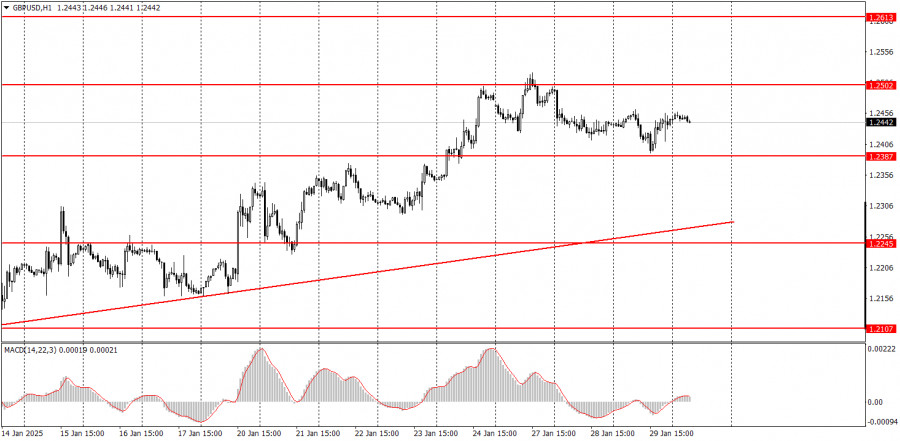

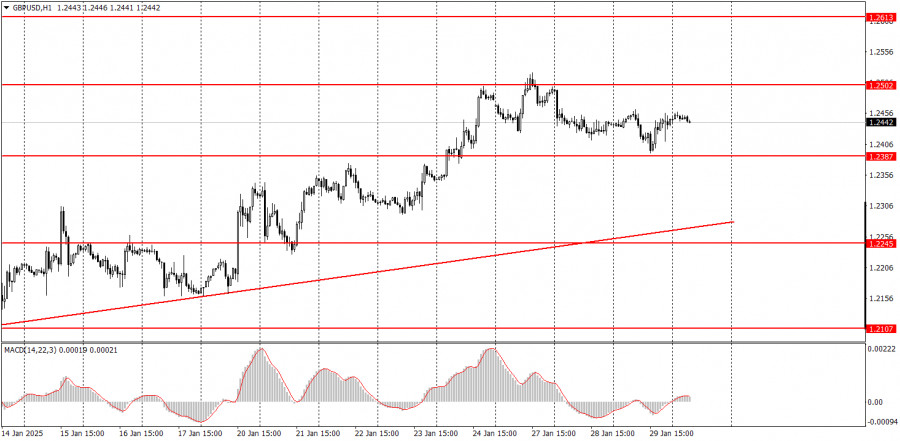

1H Chart of GBP/USD

The GBP/USD pair traded very sluggishly on Wednesday, with markets feeling cautious about any unexpected statements from Jerome Powell. However, Powell essentially repeated his previous comments. The main difference was that the Federal Reserve now describes inflation as "moderately elevated," which further diminishes the likelihood of easing monetary policy by more than 0.5% in 2025. We believe the results from the Fed meeting should be viewed as "moderately hawkish," but market participants have largely overlooked this. The pound sterling continues to trade well above the ascending trend line, indicating no immediate reason to expect a decline. However, it's important to note that the euro and the pound are closely correlated, and the euro has consolidated below its trend line. This situation presents two possibilities: either the pound will break the trend line due to a decline, or the euro's breakout from its trend line will be deemed false. With several fundamental and macroeconomic events occurring today, market movements throughout the day may help clarify the situation.

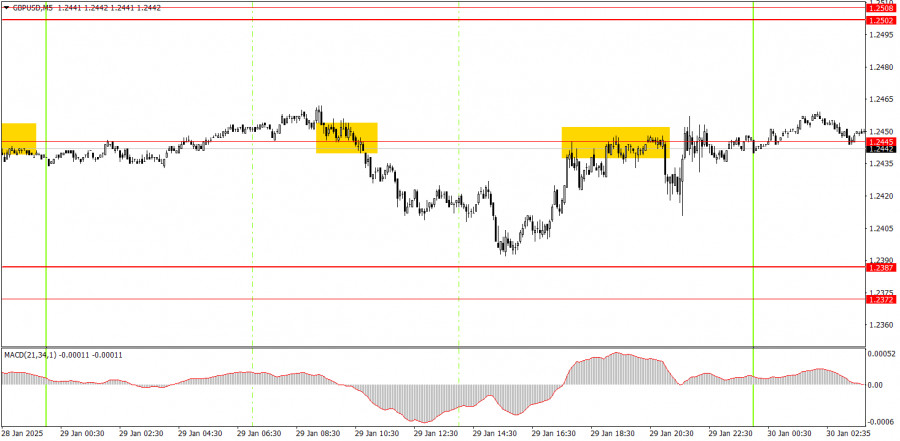

5M Chart of GBP/USD

On the 5-minute time frame on Wednesday, the trading pair generated two sell signals near the level of 1.2445. The first rebound occurred during the European trading session, while the second took place during Powell's press conference. There was little value in acting on the second signal, as the price could move sharply in either direction. The first signal, however, proved to be quite successful, with the price nearly reaching the nearest target level of 1.2387.

Trading Strategy for Thursday:

In the hourly time frame, the GBP/USD pair continues to exhibit a short-term upward trend, which we consider to be a correction. In the medium term, we fully anticipate a decline in the pound with a target of 1.1800, as we believe this is the only logical outcome. We are now waiting for the moment when the downward movement resumes, and the trend line will help us determine the conclusion of the current correction.

On Thursday, the GBP/USD pair may continue its downward trend since it has not surpassed the 1.2502-1.2508 area. However, much will depend on the outcome of the ECB meeting today.

On the 5-minute time frame, trading can currently occur at the following levels: 1.2010, 1.2052, 1.2089-1.2107, 1.2164-1.2170, 1.2241-1.2270, 1.2301, 1.2372-1.2387, 1.2445, 1.2502-1.2508, 1.2547, 1.2633, 1.2680-1.2685, 1.2723, and 1.2791-1.2798. There are no significant events scheduled in the UK on Thursday, while the US will release its GDP report for the fourth quarter. Additionally, we would like to remind you that the ECB meeting may also have an impact on the British pound.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.