Analysis of Wednesday's Trades

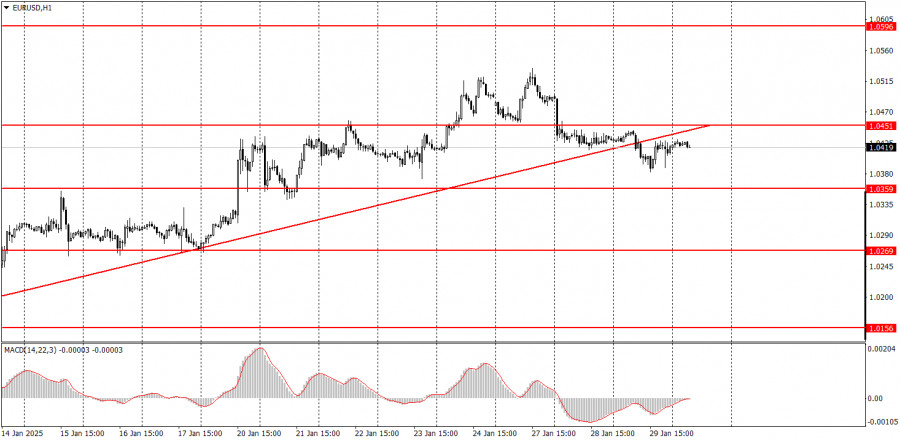

1H Chart of EUR/USD

On Wednesday, the EUR/USD currency pair did not exhibit the expected movements. Volatility remained low throughout the day, and following the FOMC meeting, there was little change in the market. Prior to the FOMC decision, no significant or even secondary economic reports were released from either the Eurozone or the U.S., leaving traders with minimal information to react to. From our perspective, the U.S. dollar should have strengthened after Powell's speech, in which he reaffirmed the Federal Reserve's independence from former President Donald Trump. Essentially, the Fed chair made it clear that the central bank will not bow to political pressure regarding monetary policy easing. However, the market interpreted this information as expected, leading to a lack of reaction. Despite this, the currency pair has settled below the trendline, and the outcomes of the FOMC meeting can be viewed as moderately hawkish. Therefore, we anticipate further strengthening of the U.S. dollar in the near term.

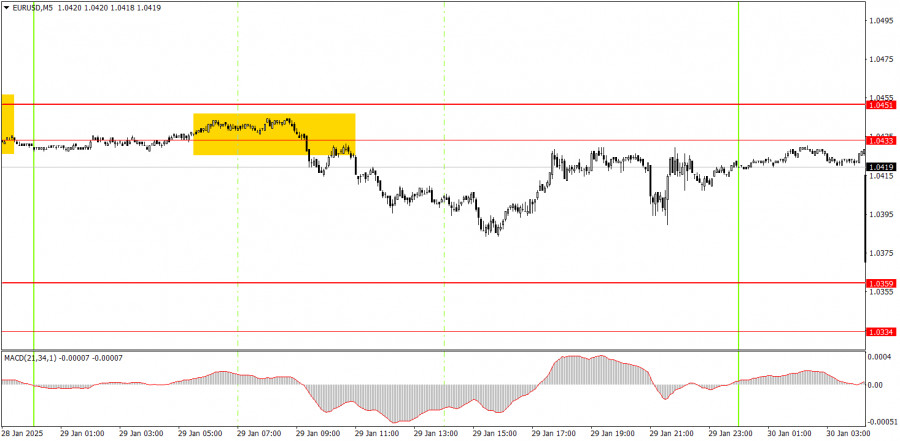

5M Chart of EUR/USD

On the 5-minute timeframe on Wednesday, only one trading signal was generated, and the price movements throughout the day were rather lackluster. During the European trading session, the price rebounded from the 1.0433-1.0451 range and moved approximately 30 pips downward. However, just before the FOMC decision, the pair returned to its original position, making it unlikely that traders could have gained significant profits from this movement. No additional trading signals were generated.

Trading Strategy for Thursday:

On the hourly timeframe, the EUR/USD currency pair is currently in a medium-term downtrend. The local uptrend observed yesterday has now reversed. We expect further declines for the euro, as both fundamental and macroeconomic conditions continue to favor the U.S. dollar. We anticipate a new wave of appreciation for the USD in the near term.

On Thursday, we can anticipate a potential decline in the pair if the price remains below the 1.0433-1.0451 range. However, it's important to keep in mind that today is the ECB meeting, which could lead to an emotional reaction in the market.

On the 5-minute timeframe, the following levels should be noted: 1.0156, 1.0221, 1.0269-1.0277, 1.0334-1.0359, 1.0433-1.0451, 1.0526, 1.0596, 1.0678, 1.0726-1.0733, 1.0797-1.0804, and 1.0845-1.0851. On Thursday, the EU will announce the results of the ECB meeting, and GDP reports will be published for Germany, the EU, and the US. With such a wealth of data, significant market movements can be expected.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.