The GBP/USD currency pair attempted to continue its upward movement on Tuesday but ultimately fell short. On Monday, the market was driven by enthusiasm surrounding an event or expectations of one, but by Tuesday, that momentum had completely dissipated. We suspect that Monday's movement was merely a technical correction. Alternatively, it may have been a reaction to German inflation, with the pound strengthening simply in tandem with the euro.

Additionally, a new theory has emerged in the market, which, as is often the case, seems to explain a lot. When the U.S. dollar slightly depreciated, many experts began suggesting that Donald Trump might not impose harsh tariffs on the EU, China, Canada, and other countries. This theory posits that if tariffs do increase, they will not be significant enough to have a destructive impact on the economy or inflation. Previously, the market may have favored the dollar out of fears that Trump's presidency would trigger an immediate surge in inflation, but those fears have since subsided, leading to the dollar's depreciation.

We have always found it amusing how some theories overlook the basic principles of the market. Many experts and traders often forget about ordinary market noise, corrections, consolidations, and pullbacks. They seem to assume that every movement in the forex market is due to a specific event. It's important to remember that the exchange rate of any currency reflects the balance of supply and demand. For example, if the market has been buying dollars for three months and some traders decide to take profits, a decline in the dollar's value is a natural outcome. New data is not always necessary to trigger profit-taking. Additionally, in the forex market, multi-billion-dollar transactions occur not just for profit from price differences but also for operational purposes, such as acquiring the necessary currency for business activities or large international transactions. As a result, the dollar might depreciate slightly simply because a market maker sold a significant amount of dollars in exchange for euros and pounds to meet their currency needs. In this context, drawing long-term conclusions from a 200-pip movement is clearly unwarranted.

Long-term conclusions should be drawn from daily and weekly timeframes. On the daily timeframe, the price corrected to the Kijun-sen line and quickly stalled in its growth. Similarly, on the weekly timeframe, the pair corrected to the Ichimoku cloud and also halted its upward movement. These two Ichimoku indicator lines are very strong, making a bounce highly likely. Such a bounce would indicate a resumption of the downward trend. Of course, if U.S. economic data released this week turns out to be weak, the dollar might continue to depreciate, but this would still be in line with a correction. The long-term factors contributing to a decline in the U.S. dollar remain absent, just as they were previously.

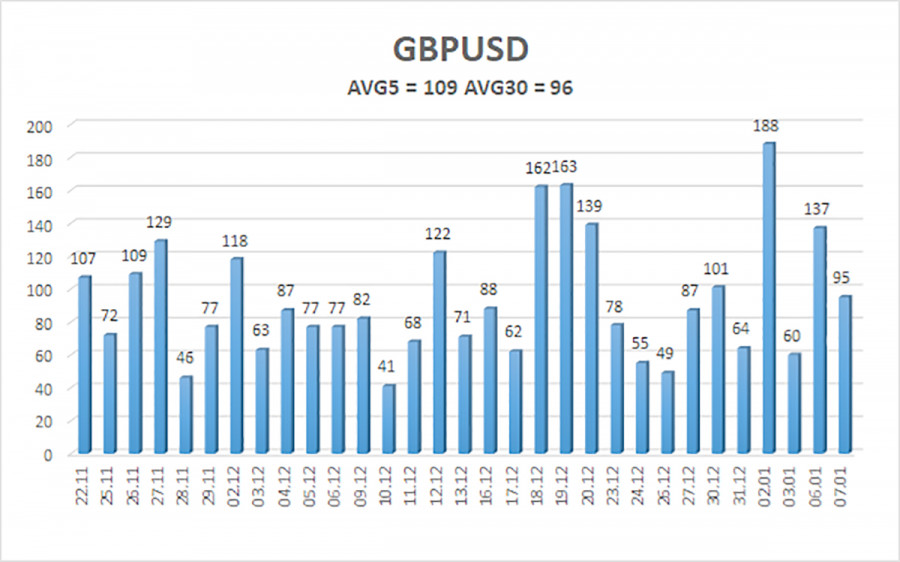

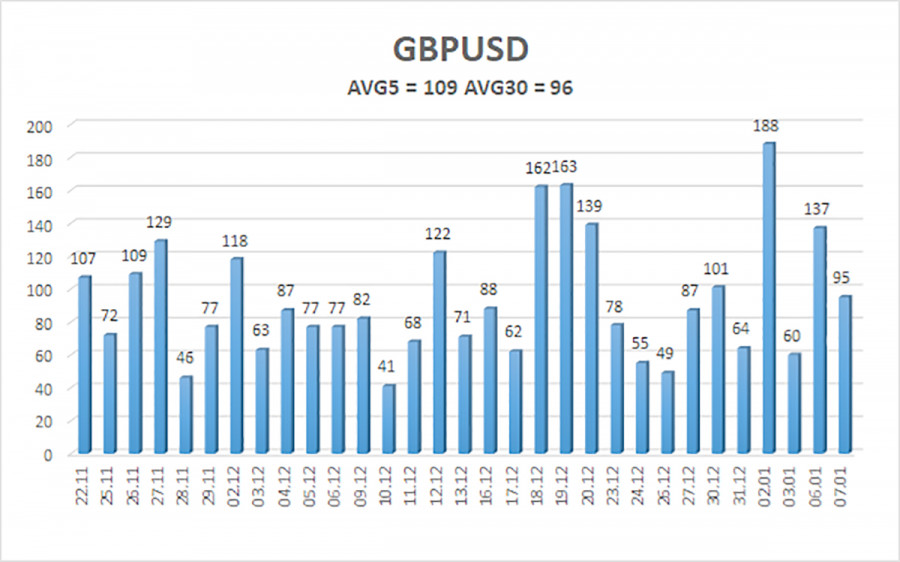

The average volatility of the GBP/USD pair over the last five trading days is 109 pips, which is considered "average" for this currency pair. On Wednesday, January 8, we anticipate that the pair will trade within the range of 1.2389 to 1.2607. The upper linear regression channel is trending downward, indicating a bearish market. The CCI indicator has once again entered the oversold territory; however, in a bearish trend, such oversold signals usually suggest a correction. The previous bullish divergence observed in this indicator, which indicated a potential correction, has already played out.

Nearest Support Levels:

- S1 – 1.2451

- S2 – 1.2329

- S3 – 1.2207

Nearest Resistance Levels:

- R1 – 1.2573

- R2 – 1.2695

- R3 – 1.2817

Trading Recommendations:

The GBP/USD currency pair is currently in a bearish trend. We are not considering long positions, as we believe that all potential growth factors for the British currency have already been priced in by the market multiple times, and no new factors have emerged. If you are trading based solely on technical indicators, long positions may be worth considering if the price consolidates above the moving average, with targets set at 1.2573 and 1.2607. However, sell orders remain significantly more relevant, targeting 1.2389 and 1.2329. It is crucial to wait for the price to consolidate below the moving average before making any sell decisions.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.