The EUR/USD pair experienced a significant decline on Friday. Traders largely paused their activity on Thursday in anticipation of a more eventful Friday, which ultimately delivered a predictable movement. Earlier in the week, important Consumer Price Index (CPI) data for the Eurozone was released, giving the euro a slight opportunity for growth. However, the inflation figures for December failed to impress the market and did not provide any indication that the European Central Bank (ECB) would consider moderating its policy stance or slowing the pace of rate cuts. As a result, after a brief uptick, the euro began its downward trend before Friday even arrived.

On Friday, the U.S. released the highly anticipated Non-Farm Payrolls and unemployment rate reports. As is often the case, experts and analysts anticipated weaker data and signs of economic deterioration. Yet, they were once again proven wrong. It can be surprising how frequently experts expect the U.S. economy to worsen. Instead, the economy added 256,000 new nonfarm jobs, significantly exceeding the forecast range of 160,000 to 200,000. While November's figure was revised downward, the data for December took precedence. Additionally, the unemployment rate dropped to 4.1%, a result that no expert had predicted. Both crucial reports surpassed market expectations, leading to a subsequent strengthening of the dollar. In our opinion, however, the dollar would have continued its rally regardless—possibly at a slower pace, but the overall trend would have remained.

In the upcoming week, the euro will once again seek support, but based on the calendar of macroeconomic and fundamental events, it's challenging to identify where such support might come from. In the Eurozone, several reports are scheduled to be released: Germany's annual GDP, Eurozone industrial production figures, and the second estimates of inflation for both Germany and the Eurozone. The inflation data from Germany and the Eurozone were already factored into the market this week, and the second estimates are unlikely to show a significant increase in consumer prices. Without such an increase, the ECB is not expected to consider scenarios for one or two rate pauses early this year. Additionally, Germany's GDP forecast for 2024 is projected at -0.2%, which indicates negative economic growth that is unlikely to enhance demand for the euro. The outlook for Eurozone industrial production is similarly bleak, with an expected year-on-year decline of -1.8%.

This week, the Eurozone reveals little support for the euro. While U.S. economic data could potentially have a positive impact, recent data has shown that U.S. indicators are generally robust. We will delve into the U.S. data in detail in the next article.

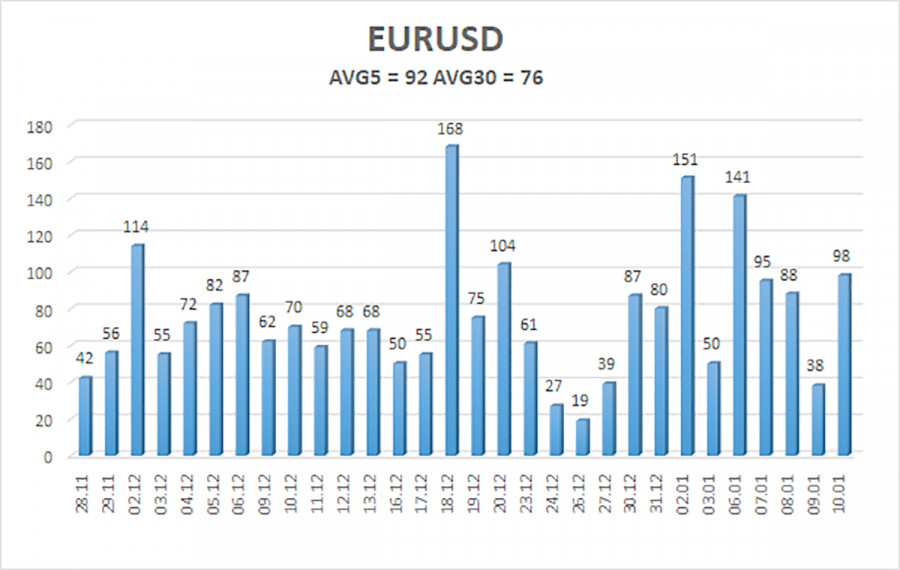

The average volatility of the EUR/USD currency pair over the past five trading days, as of January 13, is 83 pips, which is classified as "average." We anticipate that the pair will fluctuate between the levels of 1.0154 and 1.0338 on Monday. The upper linear regression channel remains downward, indicating a continuation of the overall downtrend. The CCI indicator has entered the oversold area twice and has formed a bullish divergence. However, this signal suggests only a correction, which has already been completed.

Nearest Support Levels:

Nearest Resistance Levels:

- R1: 1.0254

- R2: 1.0315

- R3: 1.0376

Trading Recommendations:

The EUR/USD pair continues its downtrend. Over the past few months, we have consistently expressed our expectations for a decline in the euro in the medium term. We fully support this overall bearish outlook and do not believe it has come to an end. There is a significant likelihood that the market has already factored in all future Federal Reserve rate cuts, which means the dollar currently lacks medium-term reasons for a decline, aside from purely technical corrections.

Short positions remain relevant, with targets set at 1.0193 and 1.0154. For those trading based solely on technical analysis, long positions may be considered if the price rises above the moving average, with a target of 1.0437. However, any upward movement at this time is viewed as a correction.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.